Getting Super Granular

Every morning I look at the list of new homes on the market, closed sales, pending sales, and price drops. I’ll often preview vacant homes just so that I can specific floor plans fresh in my mind so that I can better help my clients. I’m consistently awash in national numbers but the larger companies are consistently regional – which would be fine if they considered south Napa & Solano counties as it’s own region. Unfortunately, they lump us in with the greater Bay Area at large and we get caught in the maelstrom.

To that end, I’m going to be getting super granular this year. Although I won’t be totally eschewing the national trends, I’ll be focused on tracking our tiny regional numbers on a weekly basis looking to spot larger trends 📈 as they actually happen, rather than after. I’ll be sharing that information with you both here as well as a light-hearted recap in my weekly newsletter. You can sign up for it here.

Is Inventory Really an Issue?

There has been a significant demographic shift in the last couple of years that’s bringing in a new wave of buyers – Millenials. I hate to say it because it makes me feel like I’m on the blaming-them-for-everything bandwagon, except that I’m not. Most of them are finally at an age where they have enough earning power to purchase their first homes. Collectively, they are as large a buying cohort as the Boomers (they should also be a major political force, but that’s a different issue).

At the same time, new construction costs are soaring and new construction starts are way behind historical levels. With Boomers holding onto their homes longer, there is less inventory at the top so the top tier of move-up buyers (middle age couples with kids) have nowhere to go…which means that couples with younger kids can’t get out of their starter homes…and with no starter homes available, first time home buyers are SOL.

In case you missed it, this is a problem…I have absolutely no clue as to how much the 317 proposed single family homes at Watson Ranch will help. If these units depress any home prices, it will likely be in the older parts of American Canyon – Rancho del Mar, Victoria Faire, McKnight Acres, etc. However, judging by the new construction prices in Cordelia and the Fairfield/Vacaville area, the price point will be too high to damper AC prices.

One Cool Thing last night, and to me,

One Cool Thing last night, and to me,

320 Kent Way – Listed by Elizabeth Olcott of Keller Williams, this 4 bed, 2 bath is on the market at $435,000. It’s situated on the corner of Kent and Northampton; great location that is walking distance to schools and parks. The kitchen and family room make for great open space. The family room opens up into a sun room and a pool in the back. A great venue for entertaining.

320 Kent Way – Listed by Elizabeth Olcott of Keller Williams, this 4 bed, 2 bath is on the market at $435,000. It’s situated on the corner of Kent and Northampton; great location that is walking distance to schools and parks. The kitchen and family room make for great open space. The family room opens up into a sun room and a pool in the back. A great venue for entertaining.

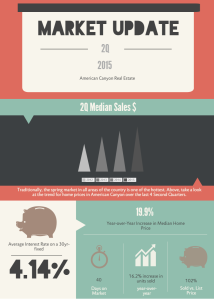

is now (according to N.A.R.) the second hottest market in the country, American Canyon home prices continue to rise while length of time on the market continues its dramatic decline. From a high of 97 days on market as recently as February, the days on market in the area is down to 40. According to Bankrate.com, the average 30-year fixed rate is hovering around 4.14%. With rates expected to increase to 5% by the end of the year, once seemingly fickle buyers are starting to pounce. For its size, American Canyon still has modest inventory but the levels are remaining stable at around 20 homes for sale at any given time. Look for a continued strong market in the City through the rest of the year.

is now (according to N.A.R.) the second hottest market in the country, American Canyon home prices continue to rise while length of time on the market continues its dramatic decline. From a high of 97 days on market as recently as February, the days on market in the area is down to 40. According to Bankrate.com, the average 30-year fixed rate is hovering around 4.14%. With rates expected to increase to 5% by the end of the year, once seemingly fickle buyers are starting to pounce. For its size, American Canyon still has modest inventory but the levels are remaining stable at around 20 homes for sale at any given time. Look for a continued strong market in the City through the rest of the year.